Indemnity Calculator Kuwait has many benefits for workers in Kuwait, i.e., workers’ payment and end-of-service benefits. When an employee in Kuwait leaves his job, it is a crucial step to remain completed under Kuwait labor laws.

Mohdhasan created the Android app Indemnity Calculation Kuwait. Khalifa remains classified as Private. As of November 4, 2022, the version is 2.4. According to a Google Play Indemnity calculation, Kuwait achieved more than 8,000 installs. Kuwait’s indemnity computation currently has eighteen reviews with an average vote value of 3.8.

Table of Contents

How to Calculate Compensation In Kuwait Under Kuwait Labor Law

Over the years, there has been much discussion about the termination of services and employees or benefits after the end of services. There are many questions concerning the benefits of termination indemnity. Most of the time, the questions go unanswered, or foreign employees leave the country without receiving the benefits they are entitled to.

Any employee working in the private sector in Kuwait is entitled to termination indemnity, regardless of nationality, according to Kuwait’s Labor Law. Nonetheless, several businesses plan to withhold wages from their workers by making fraudulent claims not covered by the law.

Employers also frequently cite their employees’ contributions to the Social Security Fund as a defense against having to pay termination indemnity. It is untrue since both the employer and the employee are responsible for paying into the Social Security fund. Each party is required to pay a certain, set percentage.

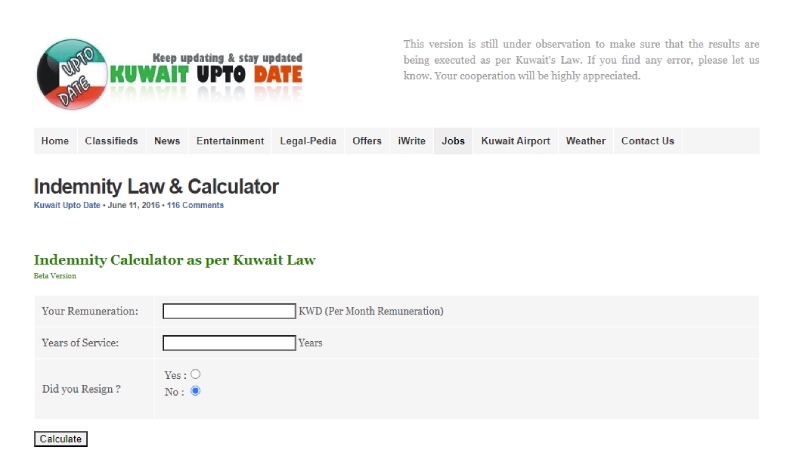

If Someone Wants to Cancel the Contract, They Can Calculate the Indemnity Through The Indemnity Calculator Kuwait.

The type of contract is the most crucial consideration when determining eligibility for termination indemnity. You must pay the company if you choose to leave your employer within three years of signing a fixed contract. This payment may be an adjustment to your termination indemnity or a full and final settlement.

With the help of Indemnity Calculator Kuwait, the employer may be able to reimburse you for the whole amount of your termination benefits if you stay with them for three more years. Employees will not be eligible for termination indemnity if their three-year contract remains incomplete.

Indemnity Calculator Kuwait Compensation Guidelines

Employees are entitled to indemnity upon the expiration of their mutual labor contract. It holds even if his employment remains terminated.

Employees are entitled to a termination indemnity for terms longer than three years, up to five years, equal to fifteen days’ basic salary for each full year of service.

Employees who have worked longer than five years are allowed a termination indemnity equivalent to thirty days’ worth of basic salary for each full year of service. However, Article 51 of Kuwaiti Laws states that the total indemnity cannot be over eighteen months.

Calculation of Indemnity for Workers Receiving Monthly Wages

In Kuwait, workers receiving monthly wages are entitled to a salary of fifteen days if they quit their jobs before five years have passed, and thirty days remain awarded for each year of service beyond five years.

For instance, a worker who has worked for the company for eight years and received KD 300 as his last pay

Total Time Spent: 8 Years

Wage last received: KD $300

The indemnity equals 15 days per year for the first five years.

There are 75 days total for indemnity in the first five years.

Weekend holidays must be deducted from these 75 days, meaning there are four to five weekends per month. Take 4 out of 30 to get 26 days.

Thus, 75 divided by 26 equals 2.88 months.

2.88 x KD 300 = 864 KD in initial five-year indemnity

After five Years, Service-related Indemnity is Equal to Thirty days Annually.

As we computed the five years above, the total service is eight years; deducting 5 from 8 yields 3 years.

Three years after five years of service

Ninety days are allotted for indemnity.

These 90 days must be subtracted from weekend holidays, meaning there are four to five weekends each month. Take 4 out of 30 to get 26 days.

Consequently, 90 / 26 = 3.46 Months

KD 300 x 3.46 = 1038 KD

After adding the first five years and the indemnity after the fifth year, we obtain

1038 KD and 864 KD

864 + 1038 = 1902 KD

1268 KD is 1902 * 2/3.

If an employee quits within five years but before ten, they will receive two-thirds of the total indemnity.

A total of 1268 KD is indemnity.

What is Kuwaiti indemnity worth? Indemnity Calculator Kuwait

Employees paid daily will also be compensated. The Kuwait indemnity calculator will calculate indemnity based on ten days of wages for employees who quit after three years and 15 days for each year of service for those who leave after five years.

- For the first five years, the worker is entitled to fifteen days of indemnity; after that, the amount increases to one month.

- If a worker leaves the company before serving three years, they are not eligible for an indemnity.

- However, if the worker leaves after three to five years, he is entitled to half of the compensation; if he stays for five to ten years, he is entitled to two-thirds of the payment.

- According to Article 51 of the Kuwait Labor Law in the Private Sector, if an employee completes ten years of employment and then resigns, he is entitled to full indemnity, one month’s salary for each year of work, up to a maximum of eighteen months.

Complete Indemnity

After ten years of employment, any departing employee is entitled to a complete indemnity.

Additionally, female employees who resign within six months of marriage are fully compensated.

Workers who have achieved retirement age and have either passed away or remain incapacitated while at work are fully compensated.

In this context, full indemnity refers to the calculation of indemnity based on 30 days of basic salary for each full year of service; total indemnity will, therefore, equal the entire amount of computed indemnity. However, Article 51 of Kuwaiti Laws states that the complete indemnity cannot be over eighteen months.

Conclusion

Indemnity Calculator Kuwait – We reviewed every aspect of Kuwaiti labor law indemnity calculation 2023 for those who work in Kuwait and want to know nothing about it. I hope you understand this idea. Tell us what you learned today and how the article went.