Pii_email_af9655d452e4f8805ebf

Table of Contents

Introduction

Microsoft Outlook is one of the further most popular email services used around the world. Many men and women use it for personal use, but some use it for personal and business use. It has built-in features that make it even more acceptable for business and personal use. Although many people use the forecast, there are various errors that individuals may encounter while using Outlook accounts. All of these problems can be due to several factors. These issues are known as pii errors and can be pretty annoying at times. But as irritating as they are, they’re also easy to fix. Microsoft error [pii_email_c0872b2275c5451a2577] There are several methods to improve the pii error, and now we will explain how to fix the [pii_email_af9655d452e4f8805ebf] error.

This bug is easy to fix, and changing some configurations can easily eliminate the viewing problem. Let’s see how you can easily fix this malfunction [pii_email_af9655d452e4f8805ebf]. If you understand the loophole, there is no need to worry about how to overcome the loophole as the approaches are there. Therefore, it would be present helpful if you could focus on getting the title of this bug. If it is not the title, then the amount of the error. Once you do, it will probably become a lot easier and you won’t have to worry about a thing, and everything will normalize. It is the most important object that you look at all the time.

[pii_email_af9655d452e4f8805ebf] Error

![[pii_email_af9655d452e4f8805ebf] Error](https://www.webtechgalaxy.com/wp-content/uploads/2021/10/ERROR-47.jpg)

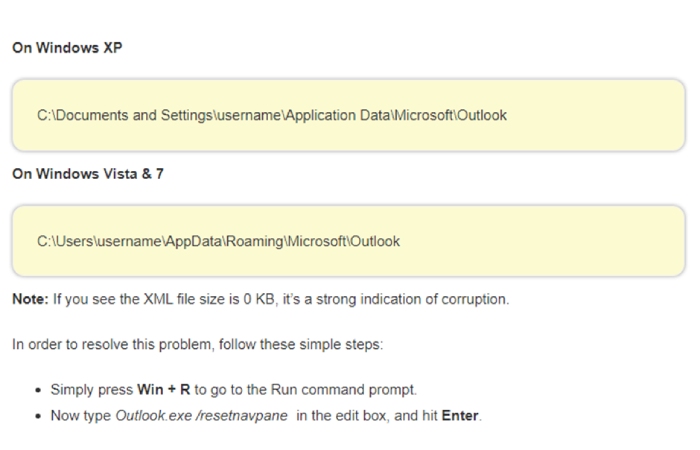

pii_email_af9655d452e4f8805ebf Various factors can cause the error. It can remain caused by improper implementation of this prediction. It can also be caused by using multiple accounts in a single display app. The foremost reason for this error [pii_email_af9655d452e4f8805ebf] is multiple, so it is imperative to determine the cause. Once done, it will help us resolve the issue quickly and hassle-free.

There are several reasons for the [pii_email_af9655d452e4f8805ebf] error, so we have created some step-by-step instructions that may help you resolve the issue. You have to follow each solution step by step. If you can fix this error [pii_email_af9655d452e4f8805ebf] at the end of the bar, then you’re fine. Otherwise, follow another bar. We potential that at the end of this manual, your [pii_email_af9655d452e4f8805ebf] error will remain fixed and that you will be able to use Microsoft Outlook without any problems. Let’s take a look at this step-by-step solution to the [pii_email_af9655d452e4f8805ebf] error, as it will help you solve the problem. Pii_email_af9655d452e4f8805ebf

The Best Addressing Method

- Update to the modern version of Microsoft Outlook

- When your PC remains updated, stop this error, you want to test Microsoft Outlook on operating system versions.

- Reflect using the Web Edition of Microsoft Outlook.

- If you consume currently received computer keyboard software along with the accounts the applications run on, here are some steps you should follow

- Log out of all accounts

- Symbol into your account

- This error [pii_email_af9655d452e4f8805ebf] can have two reasons.

- Dishonesty of Outlook application with other email accounts

- Numerous programs remain configured on your PC

- The previous step to correct this error [this is pii_email_2d113871790217b2253f] is to follow the one below.

- Download Outlook from the official website

Conclusion

Microsoft Because of other public give advice. Email remains considered one of the best strategies for communicating and reaching your audience. Along with the evolution of technologies, Microsoft Outlook is encouraged by everyone to transmit errors such as plans. If you achieve these steps, you can use the techniques mentioned above to correct the mistake.

Also read: [pii_email_f4cea690933c501337c1] Error Code Fixed

Related Searches to

[pii_email_9e750e335dfd9d75badb]

[pii_email_e97b06d078c50a765db6]

[pii_email_57a4a2f20ec6813a8481]

[pii_email_d490bb51d4b0c324a54d]

[pii_email_3b9c7cadc7ee7d3fa2e1]

[pii_email_3ceeb7dd155a01a6455b]

[pii_email_af9655d452e4f8805ebf]

[pii_email_84e9c709276f599ab1e7]

[pii_email_c0872b2275c5451a2577]

[pii_pn_8a68e8c174733080624b]

[pii_email_e188285bdb71eb7570eb]

[pii_email_5f989e2fb5d007bf52e0]

[pii_email_c742a940ba384394925d]

[pii_email_6b2e4eaa10dcedf5bd9f]

[pii_pn_8a68e8c174733080624b]

[pii_email_2d113871790217b2253f]

[pii_email_84e9c709276f599ab1e7]

[pii_email_af9655d452e4f8805ebf]

Pii_email_af9655d452e4f8805ebf

[pii_email_c75373ce5b34bf577425]

[pii_email_cbd448bbd34c985e423c]

[pii_email_e7ab94772079efbbcb25]

[pii_email_37f47c404649338129d6]

[Pii_email_7e2660f7e18dd6cdd668]

[pii_email_c1646d6cd617ef1be6ab]

[pii_email_6b2e4eaa10dcedf5bd9f]

[pii_pn_8a68e8c174733080624b]

[pii_email_2d113871790217b2253f]

[pii_email_84e9c709276f599ab1e7]

Pii_email_af9655d452e4f8805ebf

[pii_email_a096991b3f14edd32bb1]

[pii_email_a09ae663ed64d4128110]

[pii_email_a0a3164e6ca02075d826]

[pii_email_a0b04901a1f52de5a391]

[pii_email_a0f9047e89bb3009d812]

[pii_email_a14b15789a117a1ddf0f]

[pii_email_a1684ef51272d83692fc]

[pii_email_a16dfc35053cb1c44c31]

[pii_email_a1b8128daef9dfe1e816]

[pii_email_a1dc8e9d2a4dbc820d2a]

[pii_email_a1ddf2537ca3849309a7]

[pii_email_a1e9e3c9d5b7396bf9ee]

[pii_email_a1fec6329b14c42f98b5]

[pii_email_a21db73a31a2362ffd95]

[pii_email_a23822da97e9c095b475]

[pii_email_a24a96ca0e8e052c1d4d]

[pii_email_a2abdd71b7e9c7af74ae]

[pii_email_a2f0a191446a53a1e639]

[pii_email_a2fd88d45fe692cc1ae9]

[pii_email_a31bf91f3428adde5a83]

[pii_email_a33b03c38e9d001c9889]

[pii_email_a36377a0706ab27eb683]

[pii_email_a37aeab4f52a36cfec65]

[pii_email_a38b7c6e6ffab0a17237]

[pii_email_a396cae7e494894132bb]

[pii_email_a39add055032f55de7a2]

[pii_email_a3f6396e33e19d6404d2]

[pii_email_a42277285fa7a777ff7e]

[pii_email_a427253221614b6547d5]

[pii_email_a441766561daec4004b7]

[pii_email_a47129a3ea9225706d64]

[pii_email_a4a6c0b153e7e777ecc3]

[pii_email_a4afd22dca99c2593bff]

[pii_email_a4e0163fdf6d4e6b1e5d]

[pii_email_a50016ac9d0356bb6561]

[pii_email_a513f0cb889340b4dbb7]

[pii_email_a578d2645fede3887749]

[pii_email_a5791cbbbe116b64ce66]

[pii_email_a5e135e7dc4346c97744]

[pii_email_a5e6d5396b5a104efdde]

[pii_email_a5ee30aff1188da723bd]

[pii_email_a602384a3a23046a31a6]

[pii_email_a60797e3de21418bc6f7]

[pii_email_a64805dc31bea70e9b9e]

[pii_email_a64c7b8bf9eb1f61627a]

[pii_email_a65fd44c06670d5ead4f]

[pii_email_a68c44d635e501a3]

[pii_email_a6a95b3daa28af944336]

[pii_email_a6bcb9813653d21367f7]

[pii_email_a6c33e836c8e4c0dc6aa]

[pii_email_a6e51b3599d3e05eddb9]

[pii_email_a73f1b5534b6e6c9e049]

[pii_email_a7487d6f2c7087db9d4a]

[pii_email_a7b223a8a98cc7888a0a]

[pii_email_a7b5ac4459d7486f7d22]

[pii_email_a7b93224472ff079e7ed]

[pii_email_a802e401cdbf54a430fd]

[pii_email_a8208a0ca3cf3e2ec08c]

[pii_email_a82092cd8885c9372c33]

[pii_email_a833493c3484d9c7d070]

[pii_email_a861e05f6b3ccd51b36b]

[pii_email_a878f70c698d674e2f1d]

[pii_email_a89778e3cee023330e8a]

[pii_email_a8b34cbdd701832e58e1]

[pii_email_a8c301c1ca943ea5c1d0]

[pii_email_a94469a690b227acbf82]

[pii_email_a96da5aeda762b56aa1c]

![How To Solve [Pii_email_af9655d452e4f8805ebf] Error? How To Solve [Pii_email_af9655d452e4f8805ebf] Error?](https://www.webtechgalaxy.com/wp-content/uploads/2021/10/ERROR-48-768x512.jpg)

![Top 4 Outlook [pii_email_873b4a4390cfb94bc11d] Errors Top 4 Outlook [pii_email_873b4a4390cfb94bc11d] Errors](https://www.webtechgalaxy.com/wp-content/uploads/2023/03/pii_email_873b4a4390cfb94bc11d-1-768x512.jpg)