What is policy bazaar share prices?

Nse: policyBzr Fintech Limited (PolicyBazaar) SHARE PRICE

| Prev close: |

583.70 |

| P/E: |

-38.38 |

| Div yield: |

0.00% |

About PB FINTECH LTD

ISIN Sector

INE417T01026 Technology

Industry Website

Internet Software/Services pbfintech.in

CEO Employees

Yashish Dahiya 11.694K

Headquarters Founded

Gurugram 2008

NSE: Policybzr Fintech Ltd. is a online platform for insurance and loaning products. It provides access to insurances, credit and other financial products and creates awareness between Indian households about the financial influence of death, disease and damage. This company seeks to enable online research-based purchases of insurance and lending products and increase transparency, enabling consumers to make informed choices and facilitating its insurer and lending partners in the financial services industry to design customized products for consumers. NSE: Policybzr Fintech was founded June 4, 2008 and is headquartere in Gurugram, India.

Business area of the company (NSE: Policybzr)

The company is India’s leading online platform for insurance and lending products. The company provides convenient access to insurance, credit, and other financial products and aims to create awareness in India about the financial impact of death, disease, and damage.

Awards and Accreditations:

Paisa bazaar

2017: ‘Best Digital Platform for Credit Cards’ at the Economic Times cards and Payment Summit

2017: ‘Best Customer Experience Innovation in Fintech’ by Moneytech Awards.

2k17: ‘Startup of the Year’ by Moneytech Awards.

2018: Economic Times’ Most Promising Brand.

2018: ‘Best Fintech Startup 2018’ at the Drivers of Digital Awards.

2019: ‘Most Innovative Lending Startup’ by India Fintech Forum.

2021: Outstanding Crisis Finance Innovation 2021 (Asia Pacific) Award by Global Finance Magazine.

2021: Payment and Fintech Award for Excellence in Consumer Lending at the India Digital Awards, organized by the Internet and Mobile Association of India.

20k1: Digital Lending Award at the Fintech India Innovation Awards.

Policybazaar [NSE: Policybzr]

2018: ‘Best NSE: Policybzr Fintech Marketing Campaign’ award by the ‘India Fintech Forum’ at the India FinTech Awards (IFTA) 2018.

2018: ‘Ecomonic Times Best Brands – Insuretech’ award by Economic Times.

2019: Certification for ‘Great Place to Work’ received by Policybazaar.

2019: ‘Insurtech of the Year’ award at the 23rd Asia Insurance Industry Awards.

2020: ‘FE Best Banks’ award in the Fintech category by Financial Express.

2021: ‘Communications Team of the year’ award at the Kaleido Awards

2021: ‘Best Insurtech of the year’ award at the Business Leader of the Year awards presented by World Leadership Congress and Awards.

Milestone

2008: Incorporation of the Company.

2008: Investment of $ 4 million by Info Edge in the Company.

2010: Commencement of health insurance related activities.

2012: Registration of one of the subsidiaries of the Company as an insurance web aggregator with the IRDAI.

2015: Registration of Paisa bazaar as a investment adviser with SEB

2018: Built an in-house actuarial analytics team in respect of retail customer sales.

2018: Reached the $1 billion valuation mark with Series F investment.

2k18: Commencement of operations in the United Arab Emirates by PFFL.

2021: Registration of Policy bazaar as an insurance broker with IRDAI.

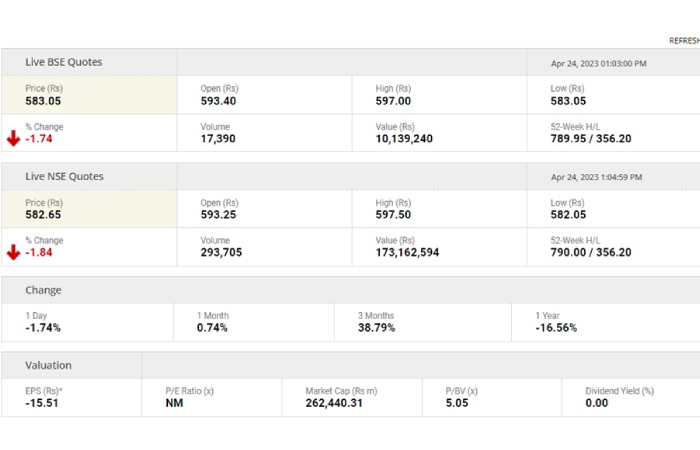

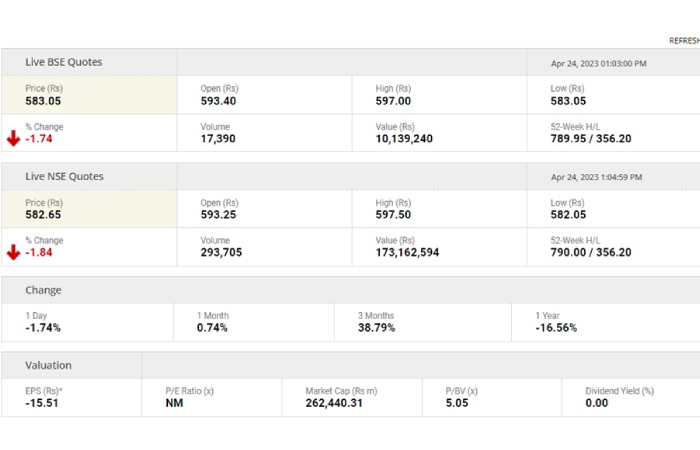

What is the share price of policy bazaar in NSE?

Policy Bazaar share price insights

| Share Price |

Value |

| Today/Current/Last |

583.70 |

| Previous Day |

592.15 |

What is (NSE) National Stock Exchange?

The (NSE) National Stock Exchange of India is one of India’s most important stock exchanges, based in Mumbai. It provides a modern trading platform for investors and traders to facilitate electronic trading.

NSE: Policybzr Share Chart (Advanced)

Which share is costly in NSE?

One costliest Stock in India. As of 15th March 2023, MRF Ltd or Madras Rubber Factory Ltd is the most expensive share in India with a price of ₹82,492.30. When MRF had its IPO in 1990, the share price was ₹ 11, and it crossed the mark of ₹ 98,599.95 per share in 2021.

Is NSE: Policybzr profitable?

Adjusted EBITDA, or profits earlier than hobby, taxes, depreciation and amortisation, for Policybazaar and Paisabazaar expanded by Rs 67 crore for the December zone, the agency stated, including that the two companies now had been worthwhile for 4 successive quarters.

Why is NSE: Policybzr PolicyBazaar share falling?

Since listing, the stock is down 67%. India’s largest online insurance company Policybazaar is facing the wrath of investors. They blame the share price fall on the company’s poor execution and valuation.

What is the Share Price of PB Fintech Ltd.?

The share price of any stocks is volatile and keeps changing throughout the day owing to different factors. PB Fintech Ltd. share price is ₹582.75 as of 21 Apr ’23.

Nse: policyBzr Share Price (POLBZ)

How to Buy PB Fintech Ltd. Share?

You can easily buy PB Fintech Ltd. shares in Groww by creating a demat account and getting the KYC documents verified online.

NSE Warns Investors Against Illegal Trading

The (NSE) National Stock Exchange Suggested traders in opposition to two persons offering unlawful ‘dabba’ trading within the stock market. ‘Dabba’ buying and selling is an illegal shape of buying and selling in stocks, wherein operators of such buying and selling earrings allow people to exchange in equities outside the inventory alternate platform.

The cautionary statements got here after NSE located that Nitin Shantilal Nagda and Narendra V Sumaria have been offering ‘dabba’ buying and selling.

These individuals have been registered with a trading member (TM) as an accepted person (AP) and the stated association as an AP changed into sooner or later cancelled through the TM.

Cautioning investors, NSE asked them no longer to enroll in this type of scheme or product presented with the aid of any character offering unlawful ‘dabba’ buying and selling hobby in the stock market because the equal is prohibited by using law.

“Investors are cautioned and counseled not to change on such illegal trading structures. Participation in such illegal platforms. Is at the investor’s very own chance, cost and results as such unlawful buying and selling systems are neither accepted nor recommended by means of the change,” the bourse stated.

Strong upside for NSE: Policybzr Policybazaar shares in long term

“Being market leader with 90% market share in the digital insurance market under Policybazaar, and 50%+ market share in the digital consumer lending market under Paisabazaar, it has a high efficient asset light business model to scale it multi x, hence considering these rationales, we believe it’s a right time to look into this story with limited calculated downside risk and followed by strong upside in long term,” stated Prashanth Tapse, Research Analyst, Sr VP Research, Mehta Equities earlier last week.

Conclusion

“The Nse: plicyBzr Fintech IPO came out with unrealistic valuations, similar to other new-age businesses during the period of technological euphoria. As the easy liquidity cycle turned with unexpected speed, we saw a sharp fall in all new-age business stocks”, said Santosh Meena, Head of Research, Swastika Investmart last month, adding, “The sharp jump in losses in FY21 and H1FY23 gave momentum to the fall in stock prices.”

Related Searches

policybazaar share price

fintech share price nse

policybazaar share price today live

policybazaar share price bse

NSE: Policybzr infotech share price nse

policybazaar share price chart

NSE: Policybzr share price nse chart

policy share price