Table of Contents

Company Overview

Bikaji Foods International Limited. nse:bikaji produces and sells food products in India. It offers bhujia, namkeen, sweets, papads, chips, and other snacks as well as oven-fresh products under the Bikaji brand name. The company sells its products through distributors, as well as online. It exports its products to North America, Europe, the Asia Pacific, the Middle East, Africa, and the United Kingdom regions. The company was formerly known as Shivdeep Industries Ltd. Bikaji Foods International Limit was founded in 1986 and is based in Bikaner, India. Address: Plot No. E-558-561, C -569-572, E -573-577, F-585-592, Bikaner, India, 334004.

About BIKAJI FOODS INTERN LTD

ISIN Sector

INE00E101023 Consumer Non-Durables

Industry Website

Food: Specialty/Candy bikaji.in

Website CEO

bikaji.in Deepak Agarwal

Headquarters Founded

Bikaner 1986

Bikaji Foods International Ltd. engages in the manufacture and marketing of snacks. Its products include Bhujia, Namkeen, Papad, snacks, sweets, and frozen foods. The company was founded by Shivratan Agarwal in 1986 and is headquartered in Bikaner, India.

Bikaji Foods International (NSE:BIKAJI) Market Cap Description

Market cap is not the actual price you pay for a company. (nse:bikaji) If you buy the company and become its owner, you become the owner of the cash the company has, and you also assume the company’s debt. The real price you pay is the Enterprise Value.

Warren Buffett uses the ratio of total market cap of all public traded companies over GDP to measure if the market is expensive. As of April 2012, the US total market cap is about $14.7 trillion, while the US GDP is about $15 trillion. The market was modestly overvalued.

Company Profile

Business description

NSE:Bikaji Foods International Ltd is a fast-moving consumer goods (FMCG) brand with an international footprint, selling Indian snacks and sweets. Its product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, western snacks as well as other snacks which primarily includes gift packs (assortment), frozen food, mathri range and cookies. The company has exported its products to international countries, including countries in North America, Europe, Middle East, Africa, and Asia Pacific.

Bikaji Foods International Limited Stock Forecast

Based on the Bikaji Foods International Limited stock forecast from 1 analysts, the average analyst target price for Bikaji Foods International Limited is INR 0.00 over the next 12 months. Bikaji Foods International Limited’s average analyst rating is Hold . Stock Target Advisor’s own stock analysis of Bikaji Foods International Limited is Slightly Bullish , which is based on 5 positive signals and 4 negative signals. At the last closing, Bikaji Foods International Limited’s stock price was INR 374.50. Bikaji Foods International Limited’s stock price has changed by +6.35% over the past week, +6.09% over the past month and 0% over the last year.

nse:bikaji Stock Performance Metrics

Stock Target Advisor calculates market performance metrics, such as capital gain and volatility, of all the stocks in our database on a daily basis and then compares and ranks the metrics against those of other stocks in the same industries and exchanges. This allows our users to quickly determine how a stock is performing against its peers.

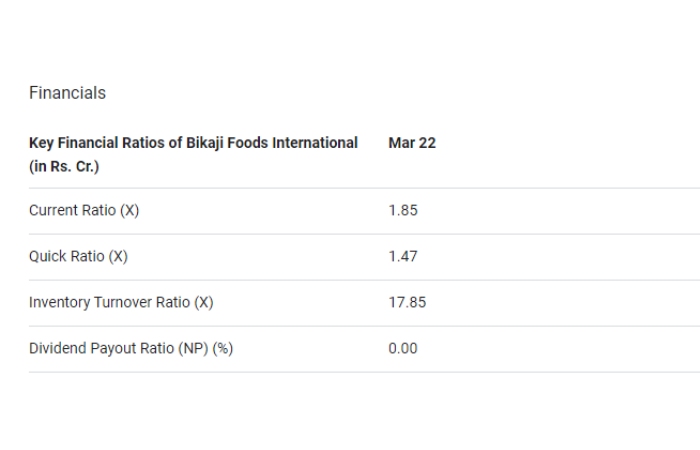

nse:bikaji Key Financial Ratios

Stock Target Advisor calculates key financial raios, of all the stocks in our database on a daily basis and then compares and ranks the financial ratios against those of other stocks in the same industries and exchanges. This allows our users to quickly determine how a stock is performing against its peers.

Bikaji Foods International Limited

Based on the nse:Bikaji Foods International Limited stock forecast from 1 analysts, the average analyst target price for Bikaji Foods International Limited is INR 0.00 over the next 12 months. Bikaji Foods International Limited’s average analyst rating is Hold . Stock Target Advisor’s own stock analysis of Bikaji Foods International Limited is Slightly Bullish , which is based on 5 positive signals and 4 negative signals. At the last closing, Bikaji Foods International Limited’s stock price was INR 374.50. Bikaji Foods International Limited’s stock price has changed by +6.35% over the past week, +6.09% over the past month and 0% over the last year.

nse:bikaji – Bikaji Foods International Ltd

Nse:Bikaji Foods International Ltd is a fast-moving consumer goods (FMCG) brand with an international footprint, selling Indian snacks and sweets. Its product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, western snacks as well as other snacks which primarily includes gift packs (assortment), frozen food, mathri range and cookies. The company has exported its products to international countries, including countries in North America, Europe, Middle East, Africa, and Asia Pacific.

Bikaji Foods IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: bikaji.ipo@linkintime.co.in

Website: https://linkintime.co.in/

Contact and Address Bikaji Foods International (NSE:BIKAJI)

Company Contact Information

Bikaji Foods International Limited

F 196-199,

F 178 & E 188 Bichhwal Industrial Area,

Bikaner – 334 006

Phone: +91 151 – 2250350

Email: cs@bikaji.com

Website: https://www.bikaji.com/

Industry

Comparable Companies

Traded in Other Exchanges

543653:India

Related Searches

[bikaji foods share price today]

bikaji foods share price live

[bikaji share price bse]

[bikaji ipo price]

[bikaji share price target]

bikaji share price graph

[bikaji share ipo]

[bikaji share name]